Understanding Demo Trading in Forex: Your First Step to Success

Are you interested in Forex trading but hesitant to risk your hard-earned money? Demo trading is an invaluable tool for both beginners and seasoned traders. It allows you to practice trading in a risk-free environment, giving you the confidence and expertise needed to navigate the real Forex markets. In this article, we will explore what demo trading is, its advantages, how to get started, and practical tips for maximizing your demo trading experience. To start, you might want to check out demo trading forex Trading Broker KW for a reliable trading platform.

What is Demo Trading?

Demo trading, also known as paper trading, is a feature offered by most Forex brokers that allows you to trade with virtual money. Essentially, these accounts simulate the live trading environment but without the risk of actual monetary loss. You can practice your trading strategies, learn how to use trading platforms, and understand market dynamics without financial consequences.

Benefits of Demo Trading

- No Financial Risk: The primary advantage of demo trading is that you can learn how to trade and develop your strategies without losing real money.

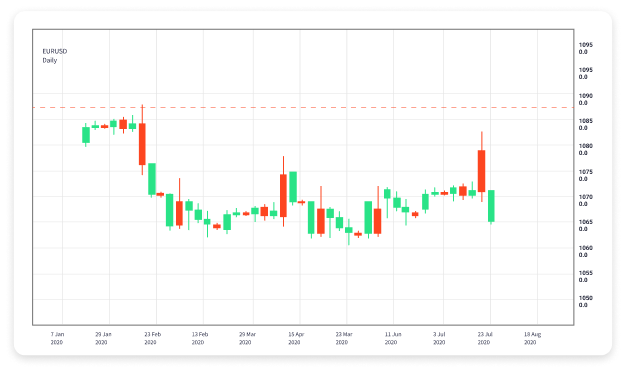

- Real Market Conditions: Demo accounts provide access to real-time market conditions, allowing you to experience how various factors impact price movements.

- Practice Trading Strategies: Use this opportunity to perfect your trading strategies. Experiment with different approaches, indicators, and time frames without the fear of incurring losses.

- Learn the Trading Platform: Familiarize yourself with the trading platform provided by your broker. Knowing where to find tools and resources can significantly enhance your trading efficiency.

- Build Confidence: Successfully managing trades in a demo account can build your confidence when transitioning to live trading.

How to Get Started with Demo Trading

- Choose a Reliable Forex Broker: Select a Forex broker that offers a demo trading option. Ensure that the broker is regulated and offers a trading platform that meets your needs.

- Create a Demo Account: Once you’ve selected a broker, go through the account creation process. Most brokers allow you to set up a demo account quickly and easily.

- Fund Your Demo Account: Although it’s a demo account, you’ll typically be given virtual funds to trade with. This amount can vary, so choose a broker that offers a sufficient amount for your practice.

- Download Trading Software: If your broker offers downloadable software (like MetaTrader 4 or 5), install it. If they have a web platform, ensure it’s user-friendly and easy to navigate.

- Start Trading: Begin trading! Explore different currency pairs, practice placing orders, and discover various strategies.

Tips for Effective Demo Trading

While demo trading can be beneficial, there are ways to maximize your experience. Here are some tips to consider:

- Treat It Like a Real Account: Be serious about your demo trading. Treat it as if you were trading with real money. This mindset will help you develop good trading habits.

- Set Goals: Establish clear trading goals for what you want to accomplish during your demo trading. It could be mastering a particular strategy or achieving a set percentage of returns.

- Analyze Your Trades: After executing trades, review your decisions—what worked and what didn’t? This reflection is crucial for your growth as a trader.

- Experiment: Don’t be afraid to try different trading strategies or styles. Demo trading is an excellent opportunity to discover what works best for you.

- Limit Your Time: It’s easy to lose track of time while demo trading. Set limits for how much time you spend to avoid developing bad habits like overtrading.

Transitioning to Live Trading

Once you feel comfortable with your trading strategies and have gained enough experience with demo trading, it may be time to transition to a live account. Here are some factors to consider during this transition:

- Start Small: Begin with a small amount of money to trade live. This approach mitigates risk while you adjust to real trading conditions.

- Stick to Your Strategies: Apply the strategies that you practiced during your demo trading experience. Avoid making emotional decisions that could lead to losses.

- Keep Learning: The Forex market is always changing. Commit to continuous learning and improvement even when trading live.

Conclusion

Demo trading is an essential step in becoming a successful Forex trader. It provides the opportunity to learn, practice, and refine your trading skills in a risk-free environment. By incorporating demo trading into your educational journey, you can significantly increase your chances of success when you decide to start trading with real money. Remember that every successful trader was once a beginner; practice, patience, and persistence are key components of their journeys.