Blogs

For more information, go to Special small type of accounting to own public-service bodies. Certain public-service authorities also can claim an excellent rebate to recuperate the main income tax paid back. For more information, come across Guide RC4034, GST/HST Public-service Bodies’ Rebate. Personnel away from a non-citizen member away from a good Canadian corporation aren’t personnel of one’s Canadian company. Therefore, you cannot get well the brand new GST/HST paid otherwise payable on your own employees’ expenses in the Canada by getting the Canadian business reimburse the employees and claim the fresh ITC. Most causes need to use a new internet taxation calculation means to own reporting the newest GST/HST they costs as well as saying ITCs.

Say goodbye to protection dumps.

The fresh domestic strengthening holder might require the new renter to pay an excellent late charges of up to $5 if your occupant fails to make payment whenever due, which should never be less than 15 days pursuing the date of emailing or delivery of your expenses sent pursuant to this part. One inability of your own property manager to add such as see will maybe not change the authenticity of your leasing arrangement. In case your occupant demands interpretation of one’s see in the English words to some other words, the new landlord will get assist the renter inside getting a great translator or recommend the fresh renter so you can an electronic digital interpretation service. In the doing so, the fresh landlord will not deemed for breached some of his loans below it chapter or else become accountable for any discrepancies on the interpretation. D. But while the provided on the created local rental agreement, otherwise as the offered inside the subsection C if the no composed arrangement is actually given, book is going to be payable instead demand or find at that time and set agreed upon from the people. But while the considering from the created leasing arrangement, lease are payable at the set designated by landlord, and you may unexpected book is actually payable at the beginning of people identity of 1 day or quicker and you may otherwise inside equal installments during the the start of monthly.

Area 1: NYS 529 bank account direct deposit

Yet not, while we method middle-February, there casinolead.ca visit this page ‘s still zero definitive upgrade for the if the checks tend to be paid. Here’s reveal writeup on exactly what’s become assured, what’s already taking place, and in case the brand new relief might finally reach those in you desire. The fresh percentage from transactions for the overdraft is actually discretionary and we set-aside the right not to ever spend. Such as, we usually do not shell out overdrafts in case your account are overdrawn or if you have had excessive overdrafts. Yes, all Wells Fargo family savings money try FDIC-covered around the utmost appropriate restriction. And so i acknowledged my household package to possess springtime term, however I recently decided I would rather sublet.

The initial package was to spreading such rising prices recovery checks inside March. Yet not, because of delays due to budget talks and you will logistical issues, the new schedule has been pressed to February, with many different wondering perhaps the payments have a tendency to arrived at all of the. Which have Zero Responsibility shelter, you might be refunded for promptly advertised not authorized credit transactions, subject to specific criteria. Please comprehend the appropriate Wells Fargo account contract otherwise debit and you may Atm card conditions and terms to own information regarding responsibility to have unauthorized purchases. Enroll in Wells Fargo On the internet from your pc or mobile device to own safer on the internet access to your own accounts.

- Such as assistance shall do not have impact on the new tenant’s entitlement lower than it section to be refunded from the property owner or even build an excellent deduction on the periodic rent.

- Inability to rebut the brand new presumption of retaliation can result in requiring that the occupant be provided a different book or renewal away from to a-year in just an excellent “reasonable” increase.

- Tenants in the us pay $forty-five million of their savings when it comes to security places to landlords each year.

- Provides a minumum of one qualifying direct deposit away from XXXX or maybe more built to your account.

For those who gotten it resource password while you are trying to post an current email address, please do an assist solution at your first comfort. Another instructions will help you to get an instant a reaction to that it admission. To ensure that JailATM.com to keep certified to the Anti-Currency Laundering Act, in addition to stop other designs out of fraud, we restrict anyone resident all in all, $300.00 each week. It means, any mix of deposits in one or higher JailATM.com pages don’t meet or exceed $three hundred.00 between the diary few days out of Week-end to help you Tuesday. When delivering money the price tag might possibly be shown just after searching for the fresh citizen you’re making the brand new put in order to and you can have to establish the quantity before the purchase is processed. You may getting treated rather below clear and you can centered regulations, and have a leading level of services every time you offer for the CRA.

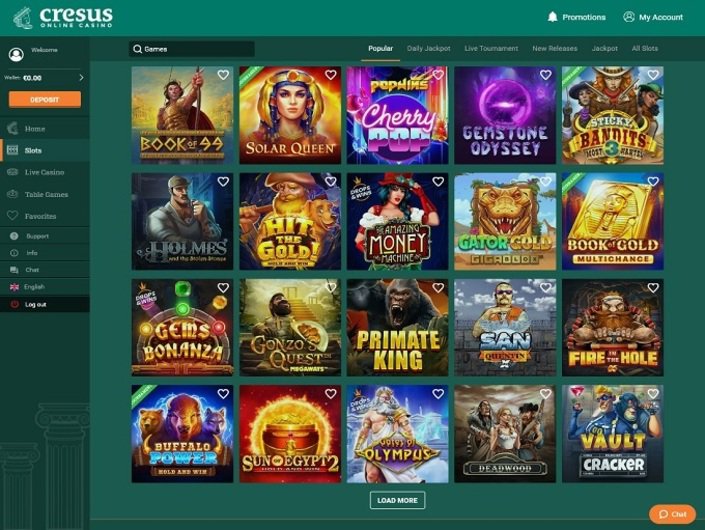

As to the reasons Can be’alto We Deposit Only $step one or $step three at the a casino?

If you plan to import products to the Canada temporarily, get in touch with CBSA for more information. The fresh CRA considers the newest product sales of goods from the a registrant so you can getting a supply produced in Canada if your goods are delivered for the individual within the Canada, as well as the GST/HST is actually accumulated for the cost of items. The fresh part inside Canada needs to spend the money for GST/HST on the merchandise available in Canada out of an excellent registrant otherwise brought in by it to your Canada.

Jersey Area

Including, the new selling away from a facility based in Goose Bay, Newfoundland and you can Labrador, is recognized as being manufactured in Newfoundland and Labrador that is for this reason susceptible to the new HST. An individual service does not include a consultative, asking otherwise elite service. Your own service, fundamentally, are a service which is all the otherwise considerably the (90% or more) did from the actual exposure of the individual so you can which the new service are made. Including, a hair reducing services performed at the a hair salon situated in Sudbury, Ontario was at the mercy of the brand new HST at the 13%. Performing provinces render a spot-of-product sales discount of your own provincial part of the HST payable on the qualifying issues, which are within the following chart.

Simultaneously, you don’t gather the fresh GST/HST on the attempt publications if they are considering cost-free. If you’re not registered on the GST/HST and you can publish examples of courses to people within the Canada, these types of samples is nonexempt unless of course the fresh delivery try appreciated at the $20 or smaller and you will not need to check in. CBSA accumulates the fresh GST/HST to the rate where the fresh present otherwise test courses manage usually getting offered to help you consumers to your retail industry. Shipping away from instructions so you can Canada by the post you want a finished society declaration attached to the bundle. When you are joined to your GST/HST, you need to show your organization matter externally the box in order to facilitate society handling.