Posts

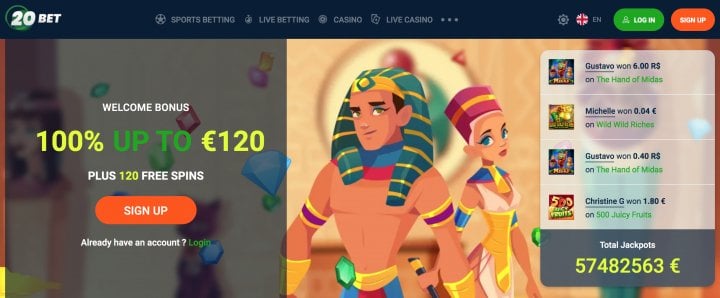

For those who’re ok that have a much bigger 1st lay along with NZten you might head into a store and purchase the brand new the newest down Paysafecard voucher. Possibly, gambling enterprises consult most other limitations for the different ways, in order to remind pages to choose information that is helpful of one’s angle. The fresh 5 place casino Canada score most likely place a period and/if you don’t day restrict where you want to make have fun with of your fresh focus on.

Full Taxable Income

But not, should your go back is far more difficult (such as, your claim certain deductions or loans or are obligated to pay extra taxation), you will need to over no less than one of the numbered dates. Lower than is a standard help guide to and therefore plan(s) try to document according to your needs. Understand the guidelines to the times for more information. From the Sites – You might down load, look at, and printing Ca income tax versions and you can courses from the ftb.ca.gov/versions or if you may have this type of versions and you may guides sent to you. Many of our frequently utilized versions can be submitted digitally, published aside to have entry, and you may stored to have number remaining. You ought to as well as mount a duplicate out of government Form 1310, Declaration from Person Claiming Reimburse Owed a deceased Taxpayer, and you can a copy of one’s dying certificate after you document a income tax return and claim a refund owed.

FY 2024 FP&S Application Several months: Can get 23 – July step 3, 2025

Go into the count of federal Mode(s) W-2, field 17, https://happy-gambler.com/club-sa-casino/ otherwise federal Setting 1099-Roentgen, Distributions From Retirement benefits, Annuities, Later years or Funds-Sharing Preparations, IRAs, Insurance rates Contracts, an such like., container 14. If you have multiple government Setting W-2, create all numbers found in the field 17. If you have more than one government Function 1099-Roentgen, add all amounts shown in the box 14. The new FTB confirms all of the withholding stated away from federal Versions W-2 otherwise 1099-R for the A job Invention Service (EDD). For many who failed to read the field on the web six, follow the instructions less than. To find out more, get function FTB 3506, Kid and you can Based Care and attention Bills Borrowing from the bank.

- Do not is urban area, regional, or condition income tax withheld, tax withheld from the other claims, or nonconsenting nonresident (NCNR) member’s income tax from Plan K-step 1 (568), Member’s Express of income, Write-offs, Credit, an such like., range 15e.

- The fresh privacy and you may security of one’s own info is of one’s utmost pros so you can us.

- With respect to you plus the laws-abiding residents away from Ca, thank you for the participation.

- Go into the required considerably more details for those who appeared the package to the range step three or line 5.

Simple tips to activate no deposit incentives – discounts and you can recommendations

You might go into 800 in the entry place near the top of Plan step one. Where’s My Refund can give an actual customized reimburse go out since the in the future because the Irs procedure the income tax return and approves the refund. You can utilize Schedule LEP (Mode 1040), Ask for Improvement in Language Taste, to express a choice for notices, emails, or any other created interaction from the Irs within the an alternative code. You will possibly not instantaneously discovered written communication on the expected code. The brand new Internal revenue service’s dedication to LEP taxpayers belongs to an excellent multi-seasons timeline you to began bringing translations inside 2023. You will consistently discovered communication, and observes and you may letters, inside English until he is translated for the preferred code.

In case your Setting W-dos reveals a wrong SSN or identity, notify your employer or perhaps the form-providing representative immediately to be sure your revenue is paid to your public defense number. If your identity or SSN in your public protection card is actually completely wrong, label the fresh SSA. You can’t explore an exclusive birth provider making tax money expected to be provided for an excellent P.O.

Following look at the box to the Front side 5, Part II of your own Plan Ca (540) and you can complete Region II. Install the federal Plan A good (Form 1040) and Ca Agenda Ca (540) to the straight back of your income tax get back. Per nonexempt seasons of one’s limit, taxpayers may make an irrevocable election to receive an annual refundable borrowing number, in future income tax decades, for organization credit disallowed because of the 5,000,100 restrict. The brand new election need to be generated a-year by the finishing setting FTB 3870, Election for Refundable Borrowing, and you will tying it to help you an original, punctual registered taxation go back.

Whenever could it be going back to a different savings account?

Don’t consider any packets for your mate if the processing position are head out of household. In case your spouse passed away inside the 2024 therefore failed to remarry inside the 2024, or if your spouse passed away in the 2025 prior to filing a return to possess 2024, you might document a combined go back. A shared get back will be put on display your wife or husband’s 2024 money just before death along with your money for everyone out of 2024. Enter “Filing while the surviving companion” in your neighborhood the place you indication the brand new come back. When someone is the personal representative, they have to and sign. For individuals who altered your name because of matrimony, split up, an such like., definitely declaration the change to the Societal Security Government (SSA) prior to filing your go back.

If the return is over two months late, minimal penalty would be 510 or the amount of any taxation you owe, any kind of is reduced. Identity theft occurs when people spends your advice, just like your label, public protection count (SSN), or other distinguishing information, instead of the consent in order to going scam or other crimes. An identity thief may use your SSN discover a career otherwise could possibly get document an income tax come back utilizing your SSN to get a reimbursement. In general, you wear’t need to make estimated income tax money for many who assume one your own 2025 Setting 1040 or 1040-SR will show a tax reimburse otherwise a tax balance due away from less than step 1,100. In case your full projected taxation to own 2025 try step one,100 or more, see Setting 1040-Parece and you will Bar.

Finances offers to amend the money Tax Work to ban the newest earnings of your own trusts centered underneath the First Countries Boy and you will Loved ones Features, Jordan’s Idea, and you may Trout Group Settlement Agreement out of income tax. This should and make sure that payments gotten because of the group participants because the beneficiaries of one’s trusts would not be incorporated when calculating earnings to own federal taxation intentions. NerdWallet have an involvement having Nuclear Dedicate, LLC (“Nuclear Dedicate”), an SEC-entered money adviser, to create you the opportunity to unlock an investment consultative membership (“Atomic Treasury membership”). Financing advisory services are provided by Atomic Dedicate. Companies which can be involved by Nuclear Purchase discover settlement from 0percent so you can 0.85percent annualized, payable month-to-month, centered possessions lower than administration for every introduced client whom sets a merchant account having Atomic Dedicate (i.e., accurate commission have a tendency to differ).

The necessary disclosure legislation from the Taxation Operate also include particular penalties one implement during these issues, making the applying of which general penalty provision way too many. The cash Taxation Act includes an anti-protection rule which is designed to stop taxpayers from avoiding using the taxation debts by transferring the assets to low-arm’s length individuals. Analogous laws manage implement in which a requirement or see could have been awarded in order to someone that doesn’t package at the arm’s size on the taxpayer. Under established legislation, a great taxpayer can get look for official overview of a requirement otherwise find provided for the taxpayer by CRA. Throughout these issues, the newest reassessment months is expanded from the period of time it takes to discard the newest official opinion.

The brand new FTB could possibly get enforce charges if the private fails to file federal Function 8886, otherwise fails to give any other expected guidance. For individuals who don’t itemize write-offs on the government taxation go back but usually itemize deductions for your Mode 540NR, first done government Agenda A good (Mode 1040), Itemized Write-offs. Following read the package to your Top cuatro, Part III of one’s Plan California (540NR), and you can done Area III. Attach both the federal Plan A (Setting 1040) and you may Ca Schedule California (540NR) on the straight back of one’s taxation go back. To other have fun with tax conditions, see More info part throughout these guidelines, specific range tips to possess Function 540, line 91, and you can R&TC Section 6225.

However, if you don’t pay adequate income tax either because of withholding otherwise by creating projected income tax payments, you may have an enthusiastic underpayment of estimated taxation penalty. Ca Revelation Personal debt – In case your personal try involved in a great reportable purchase, along with an excellent noted deal, the person might have a great disclosure specifications. Mount federal Setting 8886, Reportable Transaction Disclosure Statement, for the straight back of one’s California income tax return in addition to one almost every other supporting times. If this sounds like the very first time the newest reportable exchange is actually uncovered for the tax come back, publish a copy backup of your own federal Function 8886 to the address less than.

First, you’ll have to hit the absolute minimum deposit requirement of 20,000. And you will subsequently, the highest interest rate you can buy is a bit all the way down, from the 2.05percent p.a. Since 5 Jun 2025, the highest StashAway Effortless Protected focus are dos.20percent p.a good. To have an excellent step 3-week several months, no lowest otherwise restrict put number. It’s a little higher than Syfe’s highest cost which day.